Financial services firms must remain secure and resilient against ICT disruptions under the Digital Operational Resilience Act (DORA).

DORA entered into force on 17 January 2025 to address a critical gap in European Union (EU) regulation, ensuring firms are operationally resilient against ICT disruptions.

It harmonises operational rules and promotes enhanced cybersecurity programmes for 20 different financial entities, including banks, insurance companies, investment firms, and third-party service providers.

“DORA will help to further boost operational resilience…providing a robust framework requiring banks to foster a culture of continuous IT and cyber risk management”, said Frank Elderson, member of the European Central Bank Executive Board.

As financial institutions (FIs) increasingly leverage technologies, including critical third-party providers, cloud services, and SaaS, this creates a larger attack surface area for cybercriminals to exploit and for incidents to occur.

If these risks are not properly managed, disruptions can affect the wider financial services industry and other regulated sectors.

Compliance with DORA can’t be an afterthought; non-compliance could lead to two percent of annual turnover in fines and up to €1 million for accountable individuals.

Third-party providers face even higher fines by the European Supervisory Authorities (ESA), up to €5 million, or, for individuals, a maximum fine of €500,000.

Failure to report a major ICT-related incident or threat can also result in a monetary penalty.

FinregE’s AI-driven SaaS solutions can help your business navigate the complexities of DORA compliance, find out how.

What is DORA?

DORA is a comprehensive EU regulatory framework that aims to ensure financial institutions can withstand, respond to, and recover from ICT risks and disruptions.

Unlike previous ICT-related regulations, DORA applies to all EU member states and companies operating in the financial sector, including payments, insurance, asset managers, private equity, credit institutions, and traditional and digital banks.

Before DORA came into force, FIs managed operational risks by allocating funds to cover potential losses from incidents.

This did not cover every single ICT-related risk.

DORA was enacted as a response to increased digitisation and ICT failings.

The July 2024 CrowdStrike outage is just one example of this, where airlines, banks, and other firms were affected due to risks that were not managed properly, leading to wide-reaching implications.

What does DORA cover?

- ICT risk management – Establish and maintain a comprehensive framework to identify, assess, mitigate, and monitor ICT risks. This includes governance, accountability, and continuous oversight of ICT assets and vulnerabilities.

- ICT-related incident response and reporting – Develop processes to detect, manage, and recover from ICT incidents and promptly report major disruptions to regulators. Timely reporting improves transparency and helps contain systemic impact.

- ICT third-party risk management – Ensure robust oversight and due diligence of external technology and service providers. Firms must understand, document, and manage risks arising from outsourcing critical ICT services.

- Digital operational resilience testing – Regularly test systems and controls through threat-led penetration testing and scenario analysis. Testing validates resilience capabilities and identifies weaknesses before they can be exploited.

- Information sharing – Encourage collaboration across the financial sector by sharing intelligence on cyber threats and vulnerabilities. Coordinated knowledge exchange strengthens collective resilience across the ecosystem.

How FinregE can help with DORA compliance

Operational resilience sits at the heart of today’s regulatory priorities, and as firms become more digitally interconnected, understanding where to begin can feel daunting.

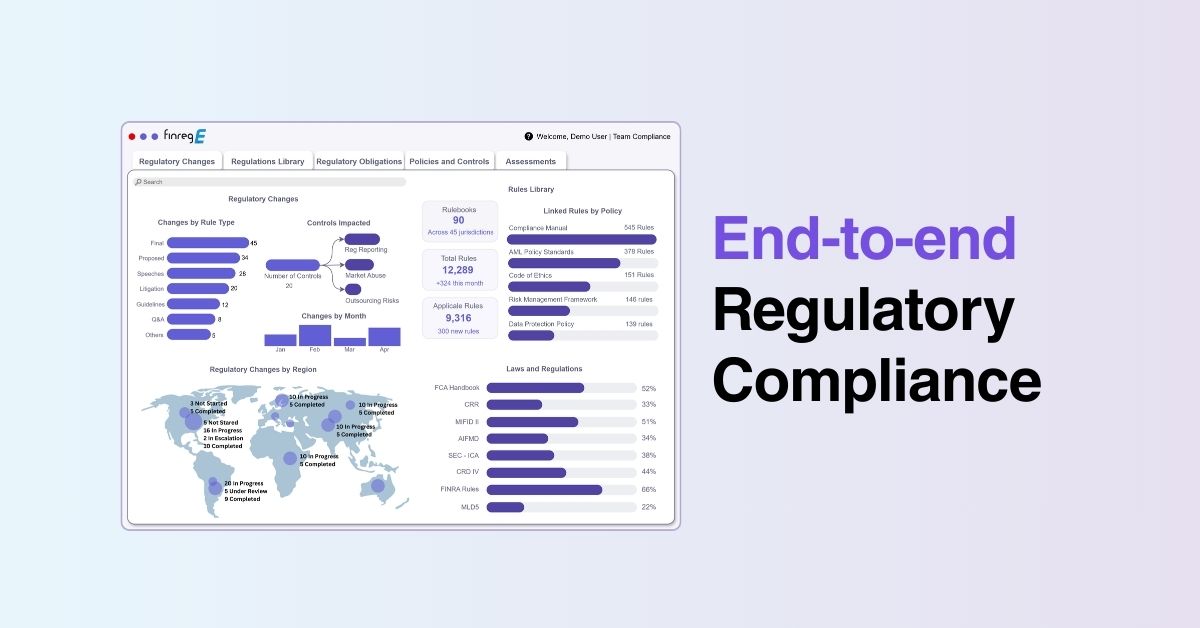

FinregE helps financial institutions translate DORA’s regulatory obligations into actionable workflows, linking policies, procedures, and risk controls directly to compliance requirements.

Our AI-powered Regulatory Insights Generator (RIG) automates the mapping of DORA rules to internal processes, helping firms identify gaps, streamline reporting, and demonstrate compliance readiness with confidence.

By combining deep regulatory expertise with intelligent technology, FinregE supports firms in building a culture of continuous resilience, not just meeting DORA requirements but turning compliance into a competitive advantage.

Book a demo today

Related resources

DORA case study: https://finreg-e.com/automating-policy-compliance-with-finreges-gen-ai-rig/

AI to help with DORA compliance: https://finreg-e.com/navigating-dora-with-finreges-advanced-ai-solutions/