UK regulators are streamlining data reporting to ease the burden on banks and save the industry £26mil annually in administrative costs.

In a move to modernise UK financial regulation, the Prudential Regulation Authority (PRA) has proposed deleting 37 restrictive regulatory reporting templates inherited from EU regulations.

These deletions form part of the Future Banking Data (FBD) programme which is a long-term strategic review of how the PRA collects and uses data.

These templates have been flagged as complex, overlapping or have become obsolete, or don’t provide meaningful supervisory value.

“It’s essential to get the right data from firms in order to supervise them properly. But it’s also important that we do that as efficiently as possible and in a low-cost way, so they can focus on their core business and supporting their customers,” said Rebecca Jackson, Executive Director for Authorisations, Regulatory Technology, and International Supervision and executive sponsor of Future Banking Data.

“Today’s announcement is another example of our ongoing work to enhance the proportionality of our regulation and support growth without risking the stability of firms or the wider financial system”, she added.

This move follows similar streamlining in the insurance sector , where reporting was reduced by one-third. The consultation paper CP21/25 also covers changes to COREP (Common Reporting) and PRA reporting, consolidation of FINREP rules in the PRA Rulebook, and alignment of remittance dates.

The consultation closes on 22 October 2025, with changes expected to take effect from 31 December 2025.

Our AI-driven platform ensures firms stay aligned with PRA’s streamlined framework while future-proofing compliance against further regulatory change.

Why is this happening

By removing unnecessary templates, the PRA is cutting duplication and wasted effort, while still ensuring supervisors get the high-quality data they need. For firms, that means lower costs and simpler processes.

This move will help the UK continue to diverge from legacy EU requirements, moving towards agile, data-driven UK-specific regulatory frameworks which boost innovation.

The PRA plans further change over the coming years to simplify and modernise regulatory requirements for banks.

The proposal at a glance

Here’s what the PRA is planning:

- To delete FINREP reporting templates which are roughly a third of the module, and about 10% of all regulatory reporting templates.

- Delete two COREP templates (C 05.01 Transitional Provisions and C 05.02 Grandfathered Instruments) and the PRA 109 OCIR template, all of which are now obsolete.

- Consolidate FINREP requirements into a single chapter of the PRA Rulebook to cut down on duplication and interpretation issues.

- Align FINREP reporting deadlines to business days instead of mixed calendar dates and thus removing operational friction.

Who is affected

- Affected firms: PRA-authorised UK banks, building societies, PRA-designated UK investment firms, and their qualifying parent undertakings. It also applies to subsidiaries of these firms, wherever they are located.

- Not in scope: Credit unions.

- Key dates:

- Consultation closes 22 October 2025.

- Target implementation is 31 December 2025 which is timed ahead of Q4 reporting

What are FINREP and COREP?

FINREP is the framework for collecting standardised financial statements from banks. It covers balance sheets, profit and loss, exposures, and more.

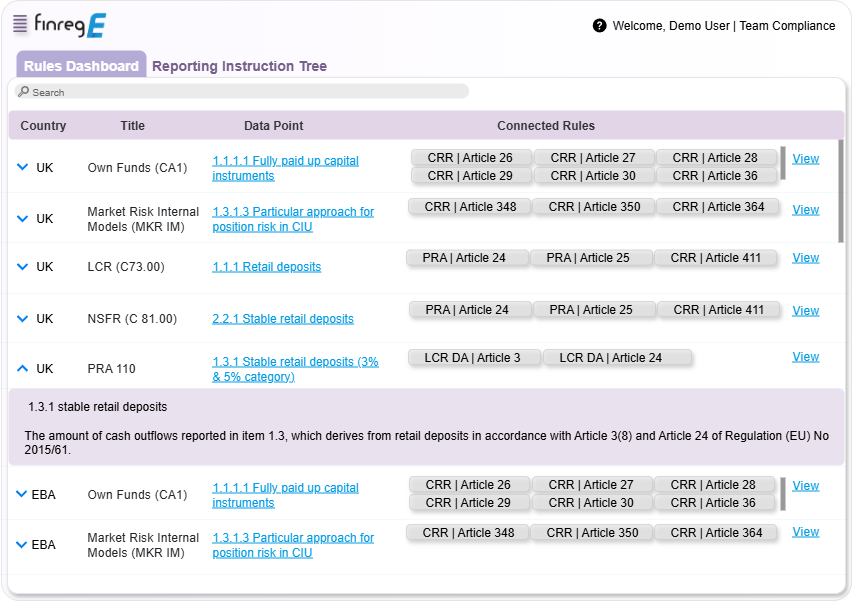

COREP is used for prudential data like capital adequacy, own funds, and risk exposures.

Both are central to how regulators monitor safety and soundness, but they are also resource-heavy for firms.

The PRA’s review found that some templates don’t add supervisory value, duplicate other reports, or reflect transitional rules that have already expired.

Removing them means firms can cut unnecessary reporting without reducing the PRA’s oversight.

How FinregE helps

Regulatory reporting simplification always looks neat on paper. The reality is that decommissioning old templates and aligning processes across finance, risk, and compliance functions is messy and resource heavy.

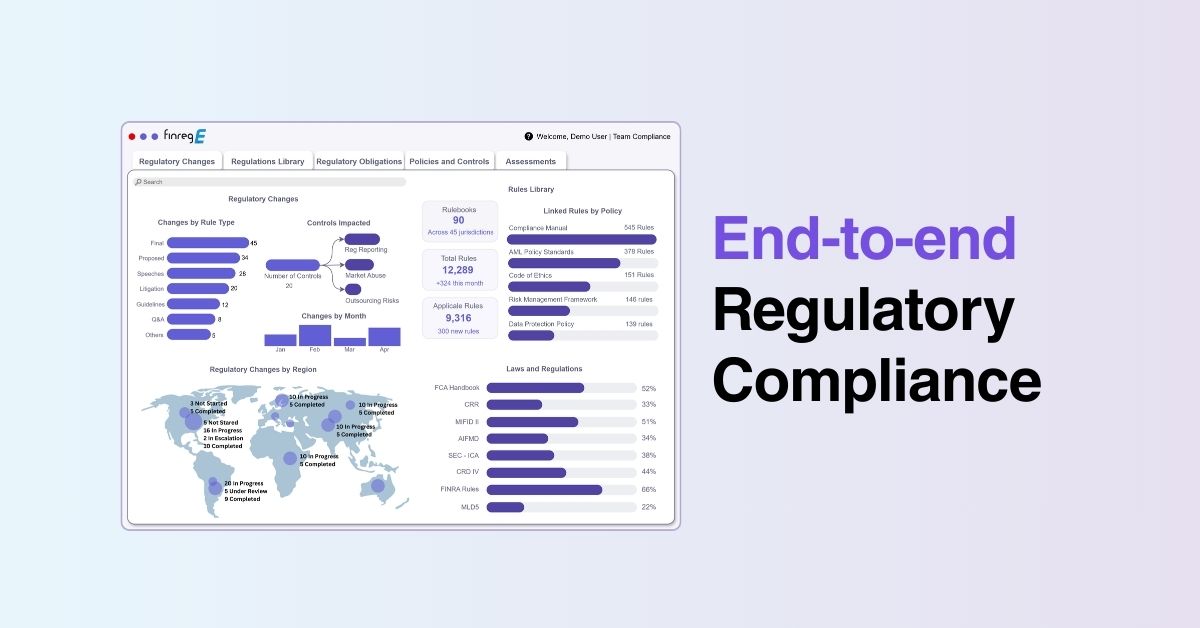

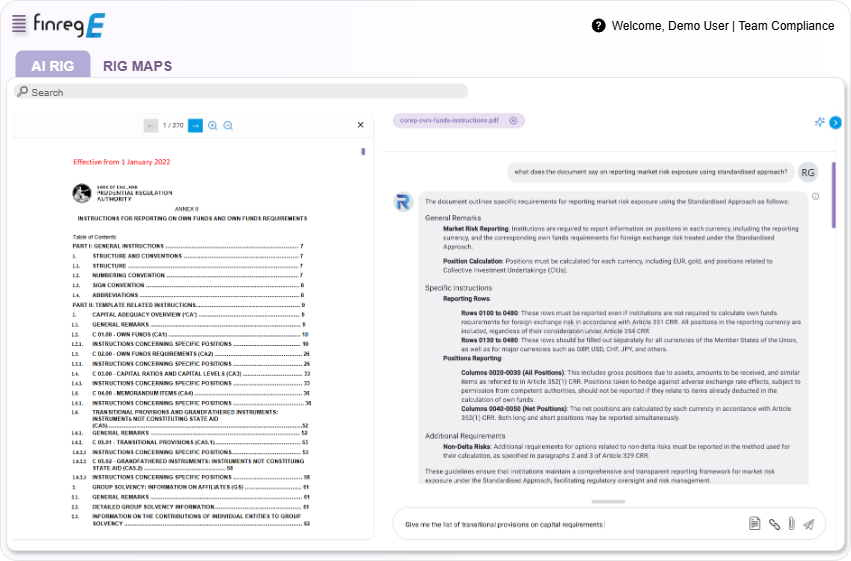

FinregE can help firms track consultations like this through Horizon Scanning, map regulatory changes directly into compliance frameworks with Digital Rulebooks and generate structured impactful insights with AI RIG (Regulatory Insights Generator).

Our reporting automation tools also make it easier to retire redundant templates without disrupting existing controls.

With implementation only months away after consultation closes, now is the time to start planning.

Book a demo today.