Ringfencing and Consumer Duty rules will be relaxed to ease regulatory burden on UK banks and boost financial growth under “the Leeds reforms”.

In a Mansion House speech, UK Chancellor Rachel Reeves described regulation as “a boot on the neck of business” and the Leeds reforms “represent the widest set of reforms to financial services for more than a decade”.

Many have complained that ringfencing regulations which mandate banks to separate retail and investment banking activities, hinder growth and activity.

These rules, which first came into effect in 2019, were designed to prevent a repeat of the taxpayer bailouts triggered by the 2008 financial crisis.

The Consumer Duty which asks firms to ensure good consumer outcomes, will be rolled back to stop it from affecting all business-to-business activities.

As part of the reforms, the Financial Ombudsman Service will be overhauled to take away its “quasi-regulator” powers by ensuring “its decisions are more closely aligned” to the Financial Conduct Authority (FCA).

Reeves proposes a concierge service which will allow:

- Foreign financial services firms to set up in the UK.

- Banks to lend more to lower-income first-time buyers.

- Listed companies to raise more than share issues without a prospectus.

“We now need to work together to bring these to life, to make sure – whether it is more first-time buyers getting access to mortgages [or] more businesses getting access to capital to start up, to scale up, and then ultimately to list in the UK – that is now our job,” said Reeves.

Regulatory changes on their way

- Ringfencing rules reforms to allow banks to be more efficient.

- Scaling back Financial Ombudsman Service powers.

- Bank of England to review bank capital requirements.

- Reasseessing the senior managers and certification regime (SMCR) that requires annual checks on employees, to reduce administrative burden.

- Revamp in-house insurance rules to lower capital and simplify reporting standards.

- Bank of England to oversee the implementation of a new UK retail payments infrastructure.

- Introducing a concierge service to make the process for international firms moving to UK or expanding to boost growth in City of London much easier. To also help firms address challenges such as visas and regulation.

How is the industry reacting

As the UK goes head-to-head for business with Paris, Singapore and New York, these reforms could help put the UK ahead in the race for financial businesses.

A Treasury official said the move would “help put the UK ahead in the global race for financial business as part of wide-ranging strategy to double down on the UK’s global strengths”. The newly announced concierge service, “a single front door to attract international financial services firms to the UK”, is a bold and welcome move.

That said, cutting unnecessary compliance burdens is always welcome but the real challenge lies in where to draw the line.

Meanwhile, Bank of England Governor Andrew Bailey argues: “Removing the ringfence would most likely have a negative effect on UK lending, both in terms of cost and quantities.”

How FinregE can help

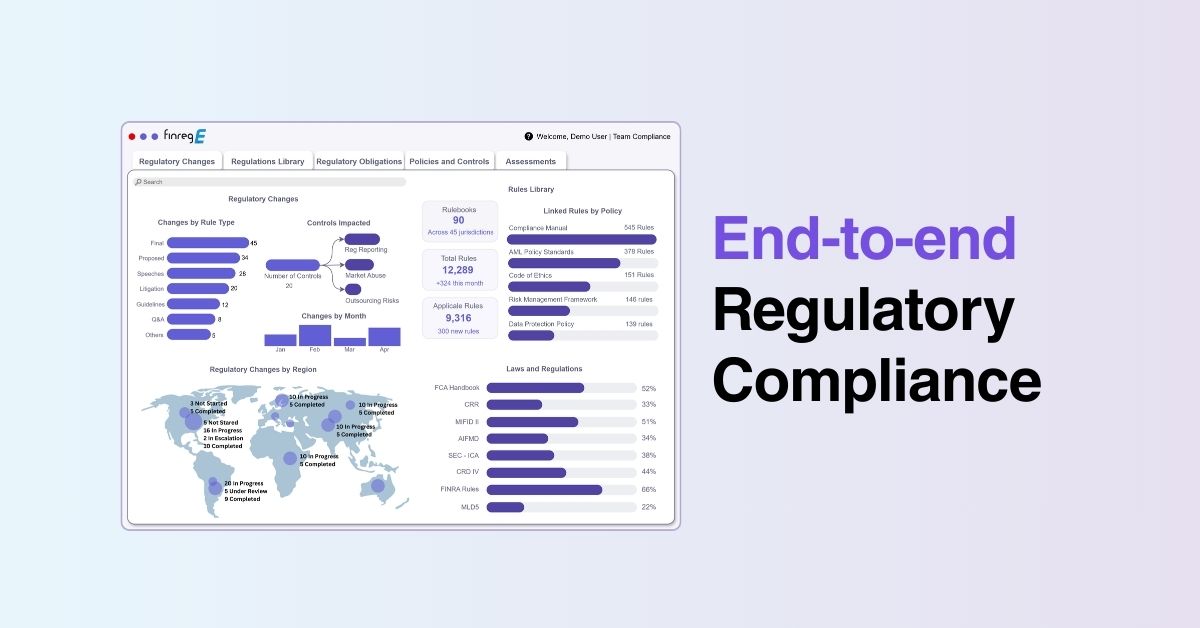

Even when regulatory changes evolve rapidly under the “Leeds reforms”, FinregE can help firms stay agile and ready to stay ahead. Through automation and machine learning capabilities, these reforms paired with FinregE’s platform can lead to greater growth opportunities.

FinregE’s experience delivering up to 80% cost reductions and saving $100k per month shows that regulatory compliance changes don’t have to hinder business growth.

Find out how we can ease your regulatory compliance burden.