Every year, organisations in regulated sectors such as financial services, healthcare, energy, telecoms, and beyond face a growing volume of regulatory requirements: new laws, changing rules, updated consultations, and jurisdiction-specific directives.

At the speed and volume at which regulatory updates are published, manual regulatory compliance management is no longer sustainable and leaves room for more errors.

The task of manually aligning regulatory requirements with internal policies, controls and risks and disconnected teams is time-consuming and a massive headache for teams, especially across borders.

Regulatory technology (regtech) solutions aim to solve this problem by automating the process of:

- Scanning for regulatory updates

- Extracting obligations

- Populating workflows

- Triggering alerts and team members

- Reporting for audits

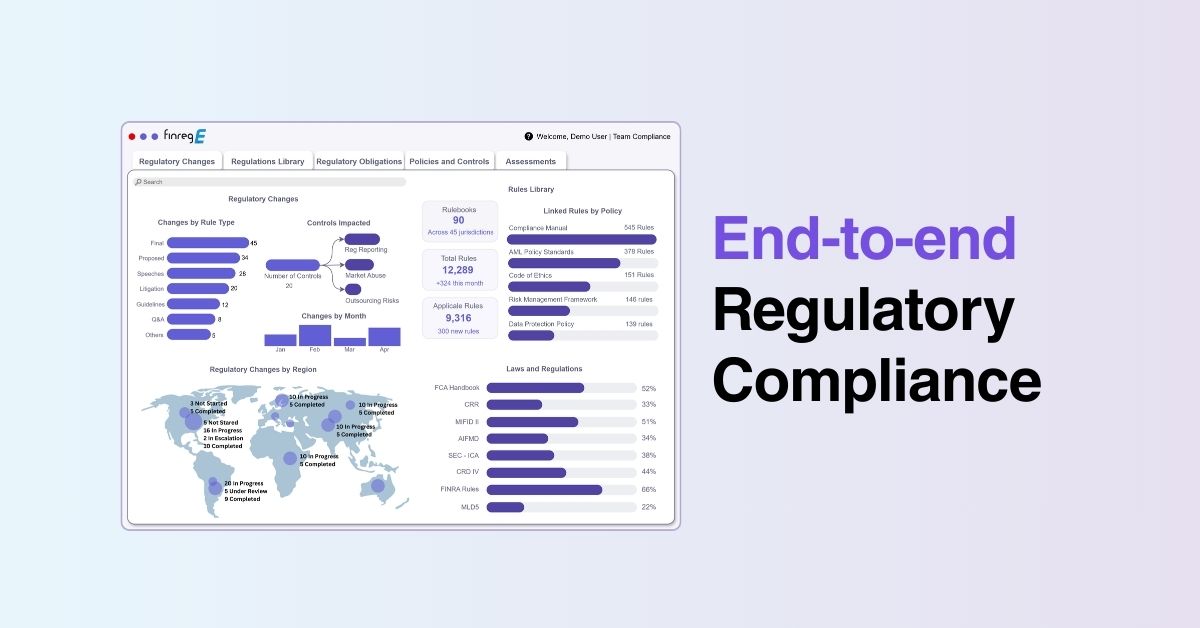

What is end-to-end regulatory compliance

End-to-end regulatory compliance refers to the complete lifecycle of managing regulatory obligations, from identifying new and evolving rules through to embedding them into a firm’s policies, controls, and day-to-day operations.

It involves continuously monitoring regulatory updates, translating complex requirements into clear, actionable obligations, mapping them across jurisdictions, and assessing their impact on the business.

By connecting regulatory change directly to internal frameworks and decision-making, end-to-end compliance helps organisations respond efficiently, reduce risk, and stay ahead of regulatory expectations in an increasingly fast-moving environment.

Why a point solution isn’t the answer

Many regtech providers claim to support the full regulatory compliance lifecycle, but in reality, few truly do. Some rely on third-party tools to fill capability gaps, while others bolt together standalone modules that don’t communicate with one another. The result is a fragmented compliance ecosystem, plagued by data inconsistencies, integration challenges, and operational friction.

Point solutions typically operate in silos and require teams to manually stitch processes together. Instead of simplifying compliance, this leads to partial automation, disconnected systems, hidden regulatory gaps, and an increased burden on already overstretched compliance teams.

We’ve seen this first-hand. Clients coming from competitor platforms often report multi-year implementation timelines, slow or unclear ROI, unreliable data, and, critically, more manual work than before. In these cases, AI fails to deliver on its promise of reducing complexity and genuinely easing compliance pressures.

What true end-to-end regulatory compliance should look like

A truly end-to-end RegTech solution handles the entire lifecycle of regulatory compliance within a single, integrated platform, not stitched together from third-party tools or acquisitions.

Here’s what that means in practice:

- Regulatory intelligence

Real-time global horizon scanning across relevant jurisdictions and sources. AI processes structured and unstructured data, translates it, and categorises it by topic, region, and rule type.

- Rule interpretation & obligation extraction

AI interprets complex legal text using NLP and machine learning to extract what’s relevant, explain what it means, and recommend next steps. This includes obligation identification, contextualised summaries, and translation for global teams.

- Mapping to your policies, controls & risks

Automatically map external regulations to your internal frameworks. This includes pinpointing where policies are missing, where controls need updating, and how to bridge gaps.

- Compliance workflows & decision points

Tasks, reviews, approvals, and attestations are routed to the right people. Human-in-the-loop signoffs are embedded into the workflow, not tracked by email or spreadsheet.

- Policy management

Instead of storing policies as static PDFs, true end-to-end solutions offer digital, governable, version-controlled policies. Teams can draft, approve, map, and audit policies in one place.

- Compliance monitoring & reporting

Create dashboards, monitor tests, track control effectiveness, and generate audit-ready trails — all linked to the originating regulatory source.

- Regulatory AI assistant

A multilingual chatbot interface trained on structured regulatory content that answers questions, extracts obligations, compares versions, and provides reasoning with citations, instantly.

How to compare vendors: The end-to-end test

To cut through marketing promises, ask these 6 questions:

- Can the vendor demonstrate complete automation of your compliance process, and show what remains manual?

- How are obligations mapped to internal policies and controls, and how is that evidenced?

- How quickly can the system adapt to new regulations (e.g. MiCA, DORA)?

- What jurisdictions and languages are covered out-of-the-box?

- Does it integrate with your GRC, risk and audit systems?

- Can the vendor demonstrate measurable ROI within months, not years?

Why FinregE is different

At FinregE, we believe automation only works if it’s integrated, explainable and trusted.

That’s why we built a truly unified, AI-powered platform to handle the full spectrum of regulatory compliance, from horizon scanning to audit-ready reporting.

We provide more than news updates, data feeds, workflow tools, or a chatbot bolted on top.

We’re the only RegTech vendor that provides every part of the compliance journey, built in-house, and chosen by regulators like the UK’s top regulator, the Financial Conduct Authority (FCA), and Moody’s.

With FinregE, you get:

- Clean, structured global data — over 2,000+ sources

- AI that explains rules, not just extracts them

- Policy & control mapping that eliminates manual gaps

- Embedded workflows with approval points

- Compliance monitoring with 100% audit trail

- A regulatory AI assistant built for the enterprise

Want to see what end-to-end compliance looks like? Book a demo to see us in action.